There are Wall Street Bullies who can profit from destroying your dreams.

“You are in a battle for your financial well-being, and you do have enemies,” said Mark Matson, Founder and CEO of Matson Money. “Your primary adversaries are Wall Street behemoths who can potentially profit and prosper by keeping you mired in problems.”

Wall Street Bullies can be masters at appearing trustworthy to unassuming investors. In some cases, they can even believe their own perspectives and can be ignorant to the rhetoric they propagate. These bullies can take advantage of investors’ deepest desires and fears for their own profit.

As a premier investor coaching company, we want to empower investors to be cognizant of these potential threats and help investors defend their financial futures from the deception of the Wall Street Bullies.

The Con Man

Most obviously, the con man is someone who promises results to dupe investors into handing over their hard-earned money. Ponzi schemes propagated by con men are often promoted by unrealistic guarantees and claims, with no apparent downside.1

How can investors easily spot a con? If it seems too good to be true, it probably is.

Perhaps the most notorious Wall Street con man is Bernie Madoff, who is attributed with masterminding a long-running Ponzi scheme estimated to involve around $65 billion.3 Much of Madoff’s success was from legitimate business, however: he created an investment-advisory business within his organization where he operated an alluring Ponzi scheme.2 Madoff was able to build a large clientele of trusting investors based on family connections, referrals, and false confidence based on his past success in legitimate business dealings.3 While Madoff was sentenced to 150 years in prison for his crimes, his victims may never recover what they lost.

One red flag that investors could have been privy to in the Madoff Ponzi scheme, and may not be uncommon in other schemes, is that Madoff did not use a third-party custodian. Third-party custodians hold the investors assets, creating a potential additional layer of accountability and protection against theft and fraud.

“Without a third-party custodian, the fox is guarding the henhouse,” said Matson.

The Prognosticator

The prognosticator believes – or wants investors to believe – that they can predict future events or developments.1 Prognosticators may be smooth talking and sound well educated, providing charts, economic theories, and no shortage of data to convince investors they can, in fact, predict the future. If successful, they convince investors to stock pick, make major changes in their portfolio and potentially dangerous decisions impacting their financial future.

“Like palm readers and psychics, prognosticators prey on our fervent and childish wish to know the unknowable,” said Matson. “When anyone tells you they know what the market is going to do in the next twelve minutes or twelve months, run – don’t walk – the other way!”

Economist and Nobel Prize winner Friedrich von Hayek said, “in the study of such complex phenomena as the market, which depend on the actions of many individuals, all the circumstances which will determine the outcome of a process … will hardly ever be fully known or measurable.”4 In fact, no human being has been able to predict the future and the economic outlook is no exception.

The Guru

Most Wall Street gurus are considered experts based on their past results and often little else.1 But, as the market can teach us, past performance is no guarantee of future results. These gurus are often sensationalized by media interviews, authors of popular books, and have been personified in blockbuster movies. They often prioritize increasing their reputation through any means necessary.5

If there are con men operating Ponzi schemes, prognosticators making defective predictions, and gurus endorsing themselves based solely on past success, is there any hope for the investor?

Your future and dreams may hang in the balance. To become the hero of your own story, it is critical for investors to consider empirically tested academic investing research, which can empower them with confidence in their long-term investing strategy… and can help them not fall victim to the perils of the financial industry.

“If you do not understand their tricks, the Wall Street Bullies will eventually seduce you with their bravado and deception,” said Matson.

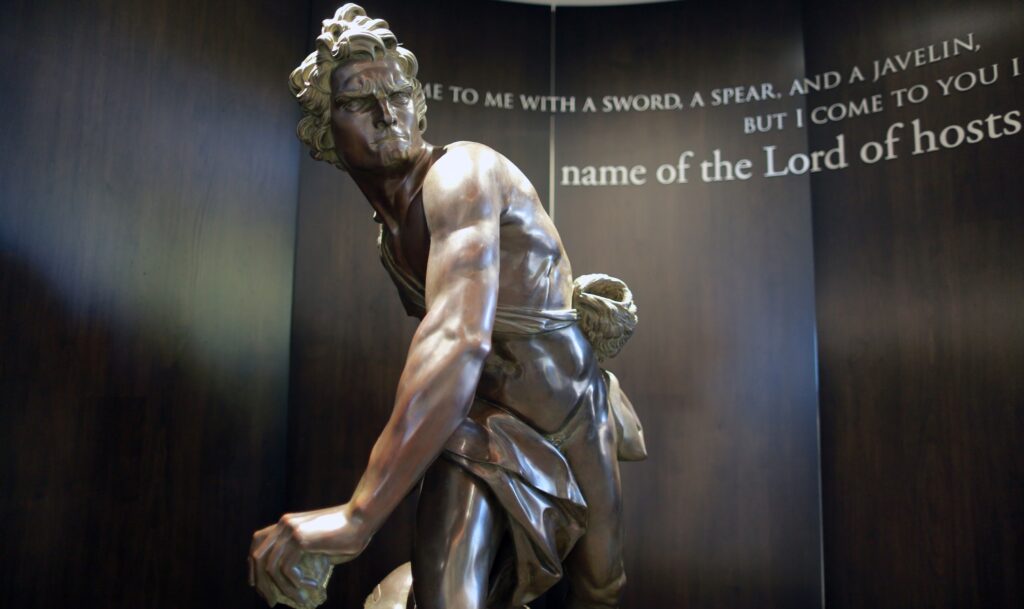

How can you deal with a bully? You can stand up to them. In David versus Goliath, David had a battle plan and it didn’t matter the size of the bully when armed with the faith in his strategy. Creating a prudent and long-term investing strategy can mean the difference between peace of mind or battling with (and potentially losing) your financial future.

Disclosures

- Matson, Mark (2021). Main Street Money: How to Outwit, Outsmart & Out Invest the Wall Street Bullies. Pg 4-6.

- Billionaire conman Bernard Madoff arrested. History Channel. December 11, 2008. Retrieved 22 August 2022 from https://www.history.com/this-day-in-history/billionaire-conman-bernard-madoff-arrested.

- Bernie Madoff In His Own Words. National Geographic. February 17, 2019. Retrieved 23 August 2022 from https://www.nationalgeographic.com/tv/movies-and-specials/bernie-madoff-in-his-own-words.

- Pretence of Knowledge. Open Risk Manual. Retrieved 22 August 2022 from https://www.openriskmanual.org/wiki/Pretence_of_Knowledge.

- Should You Listen to the Wall Street Gurus? HEC Paris. September 15, 2021. Retrieved 22 August 2022 from https://www.hec.edu/en/knowledge/instants/should-you-listen-wall-street-gurus.

This content is based on the views of Matson Money, Inc. This content is not to be considered investment advice and is not to be relied upon as the basis for entering into any transaction or advisory relationship or making any investment decision.

This content includes the opinions, beliefs, or viewpoints of Matson Money and its Co-Advisors. All of Matson Money’s advisory services are marketed almost exclusively by either Solicitors or Co-Advisors. Both Co-Advisors and Solicitors are independent contractors, not employees or agents of Matson.

Other financial organizations may analyze investments and take a different approach to investing than that of Matson Money. All investing involves risks and costs. No investment strategy (including asset allocation and diversification strategies) can ensure peace of mind, guarantee profit, or protect against loss.