Scottsdale, Arizona—Matson Money’s illustrious Board of Academic Advisors proudly grew today, welcoming legendary economist, Dr. Harry Markowitz, to its ranks. Dr. Markowitz was awarded the 1990 Nobel Prize in Economic Sciences for his pioneering contributions as the originator of modern portfolio theory, which delivered breakthrough insights about how risk and diversification impact probable returns. Alongside fellow awardees William F. Sharpe and Merton H. Miller, Dr. Markowitz launched a revolution in financial economics that continues to the present day.

He holds a PhD in Economics from the University of Chicago.

In addition to the Nobel Prize in Economics, he is also the recipient of the John von Neumann Theory Prize.

“The clarity and power of Dr. Markowitz’s work cannot be emphasized enough,” said CEO and Founder Mark Matson. “His groundbreaking research on how to intelligently manage risk has profoundly impacted how we do business here at Matson Money. Dr. Markowitz has been a significant influence on my professional life and it is a privilege and honor to have him on our Academic Advisory Board, contributing to our continuous pursuit of financial academic theory.”

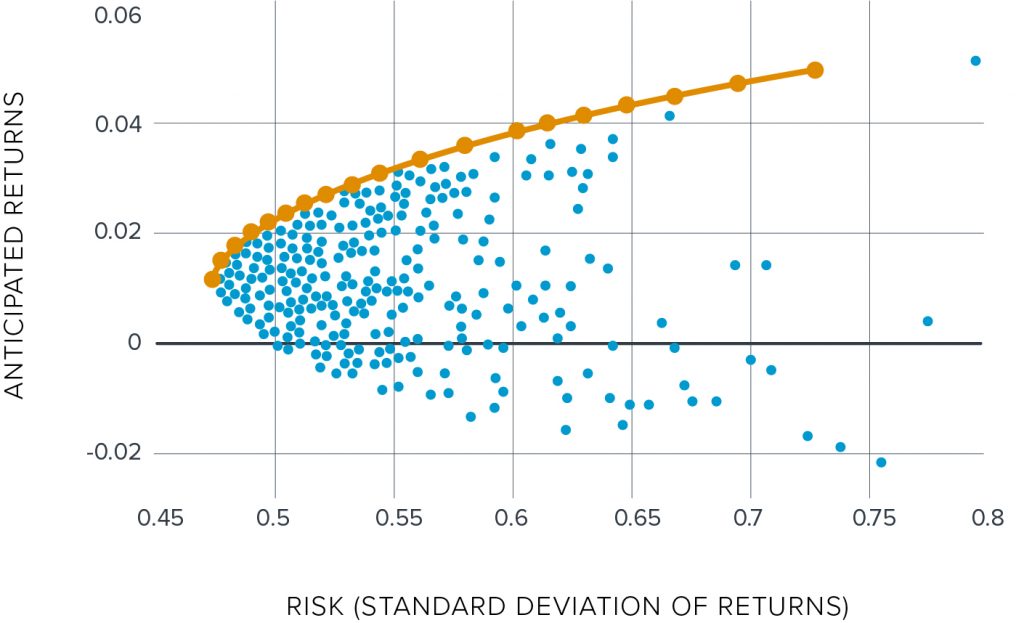

As the architect of Modern Portfolio Theory, Dr. Markowitz developed the widely recognized Markowitz Efficient Frontier, a mechanism to understand the risks in portfolio construction. The Markowitz Efficient Frontier represents the set of portfolios optimized for expected returns given a level of risk. It is currently taught in finance courses across the globe.

This graph demonstrates the relationship between risk and expected returns.

*This is for illustrative purposes only.

Dr. Markowitz’s iconic economic career continues to this day as an adjunct professor of finance and accounting at the University of California San Diego.

“I’m delighted to be a member of the Matson Money Academic Board of Directors and look forward to contributing in any way I can as Matson Money moves into its next chapter,” added Dr. Markowitz.

Dr. Markowitz joins a renowned group of economic experts on the board, including:

● Dr. Arthur B. Laffer, Ph.D. – A member of President Reagan’s Economic Policy Advisory Board from 1981-1989, he is the founder and chairman of Laffer Associates. Dr. Laffer’s economic acumen offers insights into the impact of economic policy on savers and investors. Frequently referred to as “The Father of Supply-Side Economics,” he helps navigate the complexities of the economy, interest rates and tax efficiency related to portfolio construction.

● Dr. Terrance Odean, Ph.D. – A leader in the field of behavioral finance, Dr. Odean has conducted extensive research on investor behavior, biases and habits. His findings reveal how behavior can sabotage investor performance and the ability to invest intentionally. Dr. Odean, who also serves as a professor of finance at the University of California, offers expertise relevant to the creation of coaching systems and tools for prudent long-term investing strategies.

● Dr. R. Lyman Ott, Ph.D. – As an expert in the field of statistics, Dr. Ott actively analyzes and provides third-party validation for the economic and financial research supporting portfolio construction. His studies address the probability of outcomes related to the implementation of specific investing strategies. Dr. Ott’s analysis of statistical distributions across data influence the design of portfolios.

● Dr. Muir Statman, Ph.D. – The author of several books including “Finance for Normal People: How Investors and Markets Behave”, Dr. Statman is an expert in the human dimensions of finance and economics. His work attempts to understand how investors and managers make financial decisions and how these decisions are reflected in financial markets. He is the Glenn Klimek Professor of Finance, Santa Clara University, Leavy School of Business and a Visiting Professor at Tilburg University.

● Daniel M. Wheeler – As founder of the Financial Advisor Services group at Dimensional Fund Advisors, Wheeler has been instrumental in bringing modern portfolio theory to fee-only financial advisors. Throughout his career, he has helped build the advisor community and change investment advice in retail markets, transforming a broker-driven system into one defined by financial education and coaching.

Academic Board members received compensation from Matson Money for their contributions to the firm.

“Dr. Markowitz’s indispensable insights have made possible a rigorous mathematical approach to long-term wealth creation. At Matson Money, our commitment is that all investors have the opportunity to benefit from Modern Portfolio Theory and the Markowitz Efficient Frontier,” concluded Matson.

Matson Money, Inc. is a federally-registered

investment advisor firm. This is not an offer of sale of securities. All

investing involves risk, and particular investment outcomes are not guaranteed.

This press release is for informational purposes only and does not constitute

an offer to sell, a solicitation to buy, or a recommendation for any security,

or an offer to provide advisory or other services by Matson Money in any

jurisdiction in which such offer, solicitation, purchase or sale would be

unlawful under the securities laws of such jurisdiction. The information

contained herein should not be construed as financial or investment advice on

any subject matter.

Please visit www.matsonmoney.com for more information

about the firm, in particular form ADV Part 2.